Beacon ADC Deals

The ADC & Radiopharmaceuticals Pharma & Biotech Partnering Summit is developed in combination with market-leading insights from Beacon ADC Deals, currently tracking over 1500 deals to analyze trends and the company landscape.

ADC Deal Number, Type, Phase of Development & Class

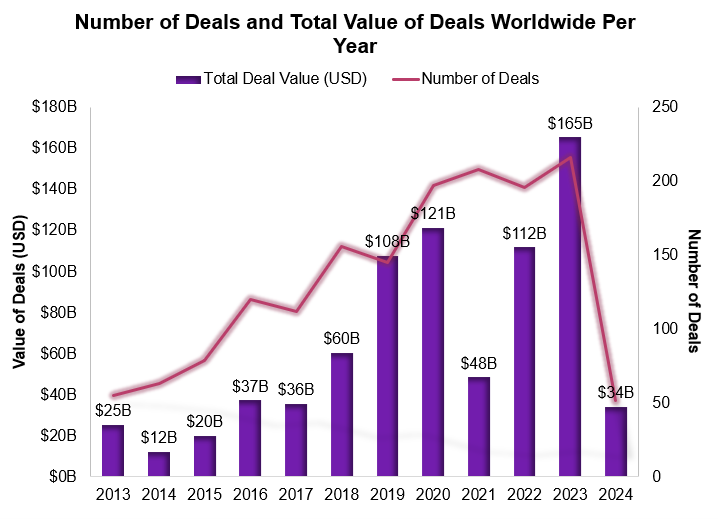

Between 2013 and 2023, 1599 deals worth $780bn have been announced in the ADC landscape. However, the number of deals along with the total value of deals, has fluctuated each year.

- The number of financing deals made during 2019 and 2020 peaked, largely due to early-stage investment into ADC drugs

- The total value of all deals per year peaked in 2023 at $165bn, due to Pfizer’s acquisition of Seagen as well as Daiichi and Merck’s collaboration to develop 3 Daiichi DXd ADCs

- 2024 so far has observed 52 deals with a disclosed value of almost $34bn

Graph 1 only represents deals where the value was disclosed, there are 538 deals with an undisclosed or unavailable total deal value. This particularly contributes to the dip in the total market value in 2021, during which 30% of the deals made did not disclose a total deal value.

Graph 1, copyright Hanson Wade 2024

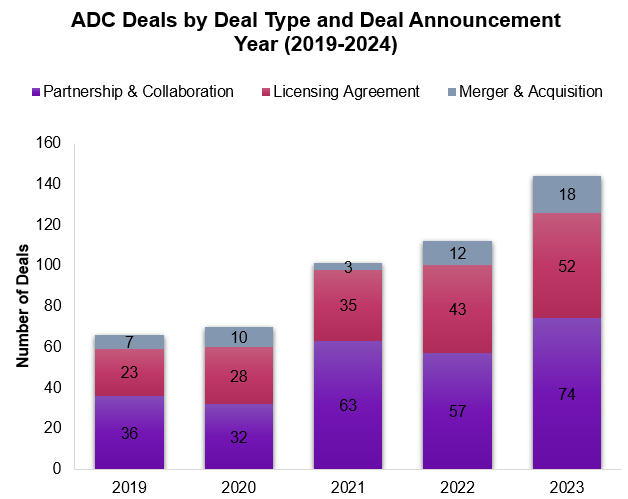

In the past five years, the partnerships & collaborations as well as licensing agreement deals in the ADC space have witnessed an almost steady upward trajectory, with an impressive average annual growth rate of 30 and 21% until 2023.

- 2023 ended up being the strongest year with 216 deals being announced in the landscape across all deal types, including financing, asset transactions, and spin-off/demergers.

- A prominent trend emerged, with financing deals leading the way and its activity peaking in 2021 followed by partnership & collaboration witnessing a significant growth of 30%, now leading the way with 17 deals so far in 2024.

Early-stage companies working in this space are benefitting from this sustained interest from big pharma and investors reflected by the growing M&A deals. Apart from Pfizer’s acquisition of Seagen, Graph 2 shows 17 more acquisitions in 2023 including Abbvie's acquisition of ImmunoGen, another specialist ADC company with programs targeting solid tumors, and then J&J's announced acquisition of Ambrx.

Graph 2, copyright Hanson Wade 2024

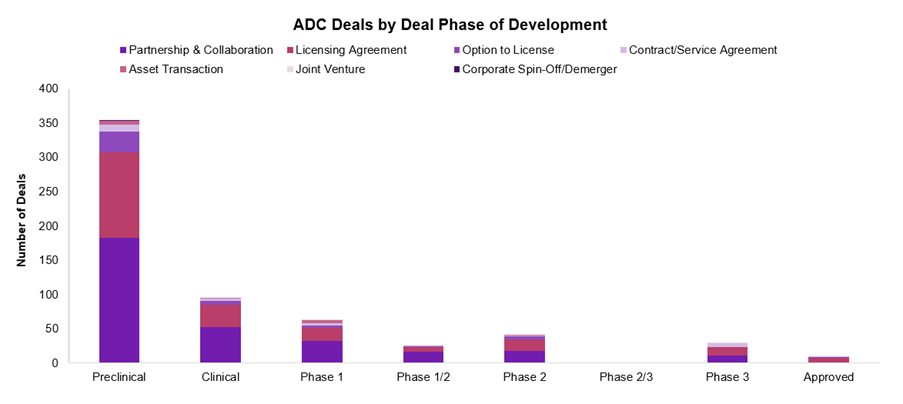

The deals based on the drug’s phase of development during the deals we observed, shows that over the years 57% of the overall deals in the ADC landscape have been made while the drug is in preclinical stages. This shows the industry’s interest in investing in promising ADC candidates before they enter clinical development.

As shown in graph 3, deals for drugs in later stages (phase 2, 2/3, or 3) made up a small fraction of the total number (12%) representing a more de-risked approach, with companies opting for assets that have already demonstrated potential clinical benefits and safety profiles.

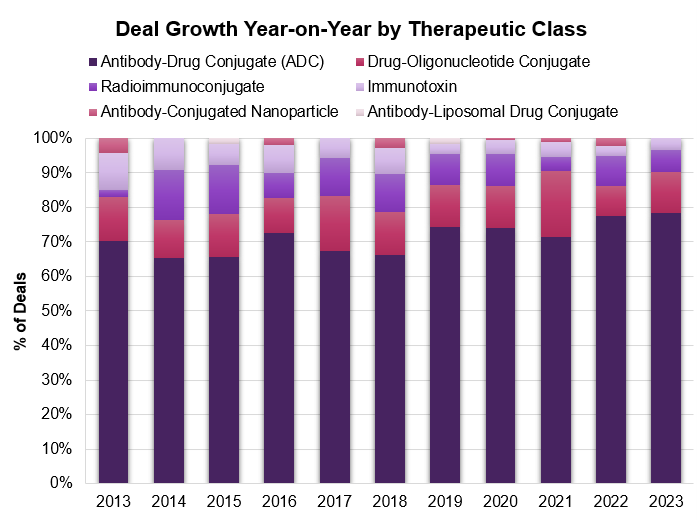

With respect to the deal growth by therapeutic class, graph 4 below shows year-on-year, the deals for ‘traditional’ ADCs keep growing significantly despite having only 13 approved therapies. Traditional ADCs have maintained an impressive 32% CAGR and attracted $520 billion in investment since 2013, showcasing enduring interest and confidence in their potential.

Graph 3, copyright Hanson Wade 2024

Graph 4, copyright Hanson Wade 2024

With innovative designs and targeted mechanisms, novel drug conjugates are gaining traction (CAGR ≈ 9%) as promising alternatives to traditional ADCs, presenting opportunities for breakthrough therapies, and addressing unmet medical needs.

Leveraging the power of targeted radiation therapy for precise tumor destruction, radioconjugates are paving their way in the market. This is marked by the announcement of AstraZeneca’s agreement to acquire Fusion Pharmaceuticals earlier in 2024, and more recently Novartis’ announcement of partnership with Mariana Oncology.

ADC Fundraising

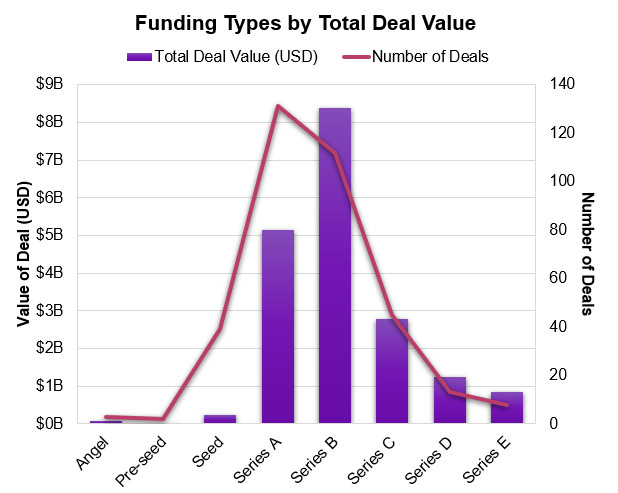

Venture investors’ activity remains high in the ADC landscape driving over 353 deals across various investment stages in the space.

- Series A funding rounds have seen higher deals indicating that an influx of capital at the seed stage is crucial for advancing promising ADC candidates through the initial stages of the development pipeline.

- While Series A deals dominate in terms of deal count, $8bn has been raised across 112 Series B investments.

- There have been 8 series E investments with the highest series E deal value of $303m announced in 2019 for ADC Therapeutics which went public in 2020. This significant late-stage investment illustrates the ability of promising ADC companies to attract substantial funding even at advanced stages.

Graph 5, copyright Hanson Wade 2024

ADC & Radiopharmaceuticals Deal Tracker

There have been a total of 52 deals in ADC space in 2024 so far of which 25 were for novel ADCs.

January

In January, Boehringer Ingelheim partnered up with Ribo Life Science to develop novel treatments for now known as MASH disease using Ribo’s proprietary technology to develop RNAi therapeutics.

Lantheus also partnered with Perspective Therapeutics to expand their radiopharmaceuticals pipeline and co-develop a prostate cancer candidate. Perspective Therapeutics will receive $28 million upfront and $33 million in investment.

Johnson & Johnson announced an agreement to acquire Ambrx for $2 billion total equity value. The lead asset is an anti-HER2 antibody-drug conjugate (ADC) for solid tumors.

February

In February, Alphagen and ArtBio based in China and US came together to develop ArtBio’s radioconjugate drug in Greater China.

March

In March, AstraZeneca announced the acquisition of Fusion Pharmaceuticals which focused on developing next-generation Radioconjugates. This acquisition marks a step forward for AstraZeneca’s growth in its area of focus.

Biotheus expanded partnership with Hansoh Pharma, with Hansoh Pharma eligible to receive up to 5 billion RMB ($694.61 million) in upfront and milestone payments to develop antibody drug conjugates.

April

In April, GenMab announced acquisition of ProFound Bio. The acquisition will give Genmab worldwide rights to ProfoundBio’s portfolio of next-generation ADCs.

Ipsen and Sutro Biopharma announced a collaboration to develop ADCs targeting solid tumors, with Sutro eligible to receive up to $900 million in milestone payments

Merck acquired Abceutics in a $208 million acquisition deal focused on ADCs and entered a collaboration with Caris Life Sciences to discover cancer targets and boost ADC development. Caris stands to receive up to $1.4 billion in milestone payments.

May

And in May Novartis and Mariana Oncology are partnering to develop novel radioligand therapies for cancer. Mariana is eligible to receive $1 billion upfront and $750 million in milestone payments.